Saving for retirement is really important. One of the best ways to do this is through a 401(k) or other employer-sponsored retirement plans. These plans help you set aside money now so you can have it later when you stop working. But, there are smart ways to make the most of your 401(k). Let’s dive into how you can get the most out of your plan, and answer common questions you might have, like “do I need to disclose 401k account” or “how do I run payroll for roth 401k?”

Know the Contribution Limits

Each year, the IRS sets limits on how much you can contribute to your 401(k). In 2025, the 401k 2025 contribution limit IRS will tell you exactly how much you can save for that year. It’s smart to stay updated on these limits because if you contribute the maximum amount, you can save even more for the future.

The simplest way I know to ensure that you are not among the under-contributing employees is to use the 401k future value calculator. This convenient instrument will assist you to understand how much your money will increase in future. Just imagine it as a window into the future in which you can look at what your savings might be like when you are through with working.

If you’re someone like Tevan Asaturi, you probably already know the importance of staying on top of your retirement plan. But if you don’t, you can visit Tevan Asaturi’s site for some great insights into maximizing your retirement plan.

Take Advantage of Employer Matching

One of the best ways to maximize your 401(k) is to take full advantage of employer matching. Many companies offer to match a portion of your contributions. For example, if your employer offers a 5% match, and you contribute 5% of your salary, they’ll add the same amount to your 401(k). It’s essentially free money! Not taking full advantage of this is like leaving money on the table.

Let’s break it down. If you make a hundred thousand a year and want to invest 5%, that’s five hundred dollars. If the employer matches that amount, then you are contributing $5,000 to your retirement savings per annum. Year after year, reinforcing that match together with compound returns can add a lot to one’s retirement savings all things considered.

But be careful! Occasionally, there’s a vesting period before the employer match is available to you in its entirety. This means that, there is a possibility that when you quit early, you will not be allowed to cash in all the money contributed by the employer. Always ensure you check the company’s vesting schedule.

Do I Need to Disclose 401(k) Accounts?

A question I often hear is: “do I need to disclose 401k account information to anyone, like creditors or lenders?” The good news is that, in most cases, your 401(k) is protected. This means it can’t be touched by most creditors, and you typically don’t need to disclose it unless you are going through a legal matter, such as a divorce. It’s one of the reasons why 401(k) plans are such a secure way to save for the future.

Plan for the Future with a 401(k) Future Value Calculator

To truly understand the power of compound interest, you should use a 401k future value calculator. This tool lets you input your current savings, expected rate of return, and contribution amounts to see how your balance could grow over time. You’ll get a better idea of how much money you might have when you retire, which can help you plan more effectively.

For instance you can invest more frequently and your investments will also appreciate on average 6% per year thus your savings are going to rise way higher than merely depositing your money in a fixed savings account. The important thing is beginning, which means your money will have a longer period to mature.

Contribution Options

It’s important to know the difference between a traditional 401(k) and a Roth 401(k). With a traditional 401(k), you contribute pre-tax dollars, which means you don’t pay taxes now, but you will when you withdraw the money. On the other hand, with a Roth 401(k), you contribute after-tax dollars, which means you pay taxes upfront, but all your withdrawals are tax-free during retirement.

Here’s a simple table to compare the two:

| Traditional 401(k) | Roth 401(k) |

| Pre-tax contributions | After-tax contributions |

| Taxes paid during withdrawal | Withdrawals are tax-free |

| Lowers taxable income now | No tax benefit today |

| Good if you expect a lower tax bracket in retirement | Good if you expect a higher tax bracket in retirement |

Knowing these options will allow you to choose the best strategy that’d suit the company most. Strange some people even prefer to contribute to both! Now, if you own a business, you are most likely to ask yourself a very important question, “How can I execute payroll for Roth 401k?” It’s actually pretty simple. It just has to be configured with the payroll service company and it also is responsible to ensure the proper deduction from the employees’ wages.

Use a 401(k) Future Value Calculator

A 401k future value calculator can help you see how much your retirement savings will grow. This is useful because it allows you to adjust your savings strategy based on your goals.

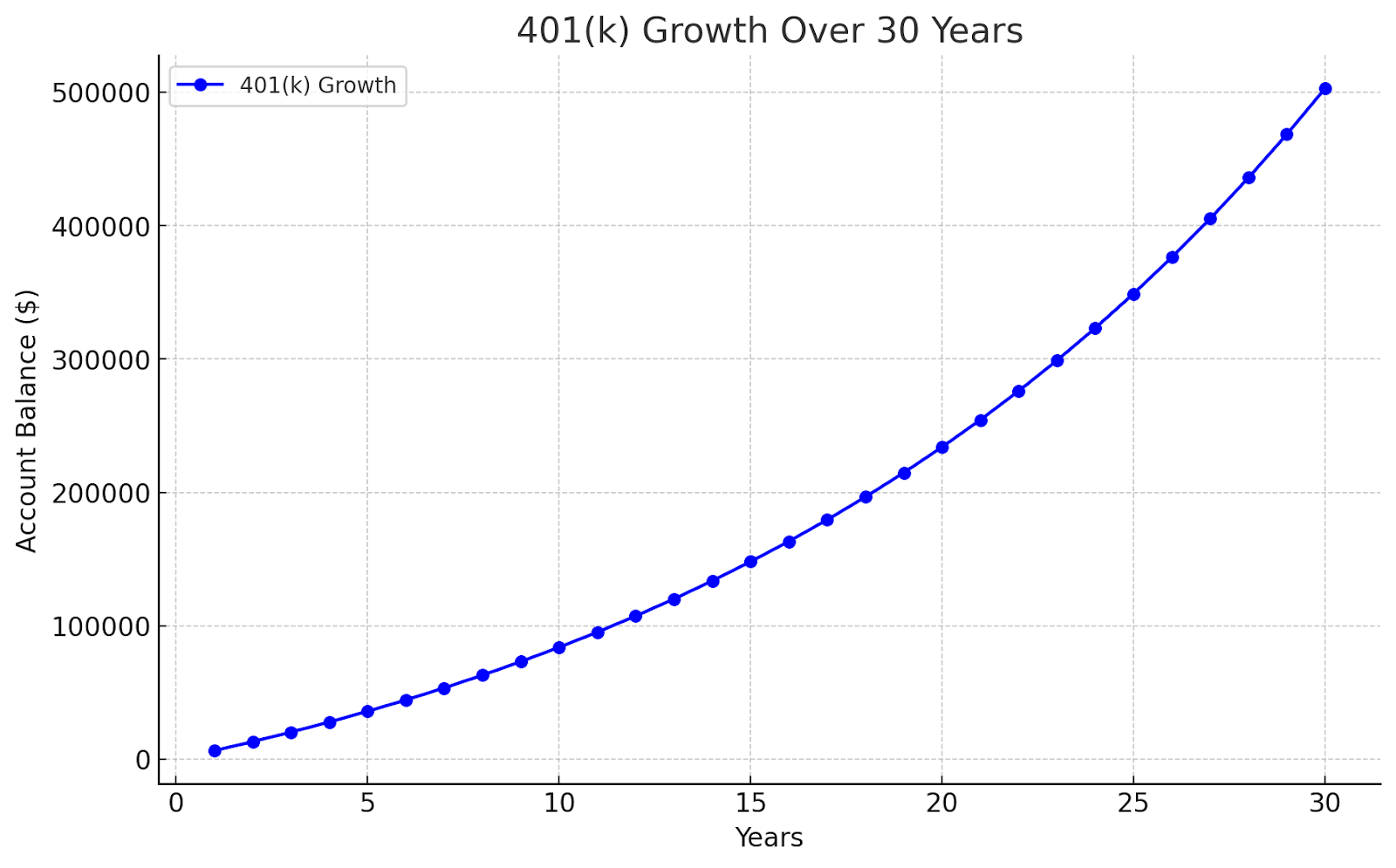

Here’s a graph that shows how much your 401(k) can grow over time if you start saving early. Let’s assume you save $6,000 each year with a 6% return rate:

401(k) Growth Over 30 Years (Assuming a 6% Annual Return)

I’m now including a simplified graph showing a hypothetical growth pattern for a 401(k) plan over 30 years.

The graph above shows how your 401(k) savings can grow over 30 years, assuming you save $6,000 annually with a 6% return rate. You can see that starting early and consistently saving really pays off in the long run.

What About a Loan from Your 401(k)?

Sometimes, emergencies happen, and you might need money fast. Many 401(k) plans offer loans, like the Empower 401(k) loan. This allows you to borrow from your own savings and pay yourself back with interest. However, it’s usually a good idea to avoid taking out loans from your retirement plan unless absolutely necessary, as it can slow down your overall growth.

Deadlines for Contributions

If you’re self-employed, you might have a Solo 401(k). It’s a great option because it allows higher contribution limits. But, don’t forget about the solo 401k contribution deadline! Missing it could mean you’re unable to contribute for that year, which could slow down your savings.

- Maximize your contributions by knowing the IRS limits and using employer matching.

- Consider using tools like the 401k future value calculator to plan ahead.

- Be mindful of the benefits and risks of borrowing through a 401(k) loan.

Empower 401(k) Loan: When Should You Borrow?

At some point, you might need quick access to cash for an emergency. If this happens, your plan may offer the option to take out a loan from your 401(k), like the Empower 401(k) loan. This loan allows you to borrow from your own retirement savings and pay it back with interest.

On the surface, you might decide it makes sense, and yet it is a decision with potential for negative outcomes. Borrowing from your 401(k) means that you are taking less money, which is working towards making your future funds. Furthermore, in the event that you change your employer before repaying the loan, you have the possibility to pay it back at once or face penalties. But if you are not cautious, it might turn out to be a reality, to your dismay, it may harm your retirement benefits than you intend to.

Solo 401(k) Contribution Deadline

If you are self-employed or run your own business, a Solo 401(k) can be a fantastic retirement savings option. It offers the same benefits as a traditional 401(k), but with higher contribution limits. However, it’s important to keep an eye on the solo 401k contribution deadline each year. Missing this deadline could mean losing the chance to contribute for that tax year, which could slow down the growth of your retirement savings.

Reviewing Your 401(k) Regularly

Maximizing the amount of money people can put inside their 401(k) does not end at this stage of being set up. It is also important that you constantly look at your plan. See if you are staying on course with your savings so as to ensure that you are saving adequately so as to capture the employer contribution, and also see whether your investment direction is compatible with the retirement age you want to retire at.

Sometimes, plans offer the ability to adjust your investment options as you get closer to retirement. This can be helpful, as you might want to take fewer risks as you near retirement age. Tools like a 401k future value calculator can also help you track your progress.

Key Takeaways

- Take advantage of employer matching whenever possible to boost your retirement savings.

- Use a 401k future value calculator to plan for your financial future and see how your savings can grow.

- Review your plan regularly to make sure your contributions, employer match, and investments are in line with your retirement goals.

By following these simple steps, you’ll be on your way to a more secure financial future. If you need inspiration, be sure to check out Tevan Asaturi for more helpful tips on retirement planning.

Leave a Reply